Salary Slips Format in India: The Guide for Compliant Salary Slips

Written by Frederic, Founder of PayrollRabbit

12 minutes read

Introduction

Salary slips are indispensable to India's thriving economy. This blog post will discuss in detail why a payslip matters, what salary slips are, and how to best create compliant ones for payroll professionals in India.

Payslips are among the most essential documents for your employees. They need to contain all required information and computations. Payslips are provided to your employees at the end of each month and are a summary of their earnings and deductions.

This post explains how to produce the ideal wage slip in the best format and provides free Excel and Word resources, regardless of whether you have been producing salary slips for a while or if this is your first time.

Before you start, we highly recommend our free Payslip Generator, which automatically includes all these features. Make your life easy and automate your payroll now with PayrollRabbit.

What is a Salary Slip?

A salary slip, also known as a pay slip, provides an explicit breakdown of an employee's earnings for a given pay period. It contains details such as base salary, allowances, and deductions (such as insurance and taxes).

Employees receive salary slips from their employers each month, which act as official documentation of payments. It assists firms in guaranteeing proper payment and upholding a transparent payroll procedure.

Why do Salary Slips matter?

Why are payslips more so crucial for employees and employers? How is it more than just a monthly routine?

Payslips offer employees clarity on earnings and deductions and serve as proof of income for loans, visas, or job changes. For employers, they are a legal requirement that ensures compliance, reduces disputes, and builds trust through transparency. We have compiled five main reasons why payslips matter in India:

1. Legal & HR Compliance

Indian labour laws require employers to provide accurate monthly salary slips to be 100% compliant. Large and medium-sized businesses routinely issue them, highlighting the importance of transparent HR practices, even in smaller companies where this may be less common. We strongly encourage using our free tool to ensure compliance and foster a transparent workplace with clear documentation of income and deductions.

2. Proof of employment

A salary slip verifies an employee's income and employment status. This is extremely useful when applying for visas, enrolling in international academic programs, etc. A salary slip is seen as the backbone of the Indian economy as a source of trust. That is why it is illegal and vital that people do not fake their salary slips, as you can get into serious trouble, such as getting banned by companies when you are applying for a loan or job.

3. Job Application Credibility

The most common use case of a payslip is to present it in a job application. It is here to determine an applicant's current salary. Usually, recruiters and prospective employers want to see the paystubs for the last three months. In addition to helping with the hiring process, this transparency gives workers negotiating power to increase their pay, as both parties, the employer and employee, can see how much you effectively earn.

4. Loan & Credit applications

A payslip is important for financial goals like purchasing a property or obtaining a credit card. Like a bank statement, it is used by banks to evaluate a person's income and current debts to determine whether or not they qualify for a loan.

5. Aids in tax planning

Payslips are especially useful for tax savings, as they offer employees and their tax specialists a comprehensive summary of their earnings and deductions.

The salary slip explicitly lists components that are taxed differently, such as medical allowance, travel allowance, and HRA. This enables workers to plan their finances better and optimise their tax benefits.

How do you create a salary slip?

Unfortunately, in India, most companies still use Excel or Word to create a salary slip, which we want to change with PayrollRabbit. We highly recommend you use our free payslip generator or the complete automated premium version if you can afford it. You do not ever need to re-enter employee or salary details each time, as our premium version automatically and securely pulls this data from your records. Another option is downloading our salary slip Word or Excel template and manually entering the appropriate values.

These are the following details that need to be included on the payslip:

- Company Information: Add the company logo, name, and address, and specify the salary month to ensure clear identification, professionalism and compliance.

- Employee Data: Include the employee's full name, ID, pay period, number of paid days, any loss of pay, and the salary payment date.

- Salary Calculations: Present a detailed breakdown starting with gross salary and deductions (like taxes and PF).

- Total Net Payable: Show clearly the net payable amount. It is the sum left over after all deductions (such as taxes and other withholdings) have been made from their gross pay. Another name for it is take-home pay. The sum has been credited to the employee's bank account.

- Signature: Payslips must be issued with a digital signature. Documents lacking a seal and signature are considered fraudulent or have no legal significance. Digital signatures and the company logo are commonly included on computer-generated slips. Consequently, businesses that print paystubs (which we do not recommend) want to ensure they are sealed and signed.

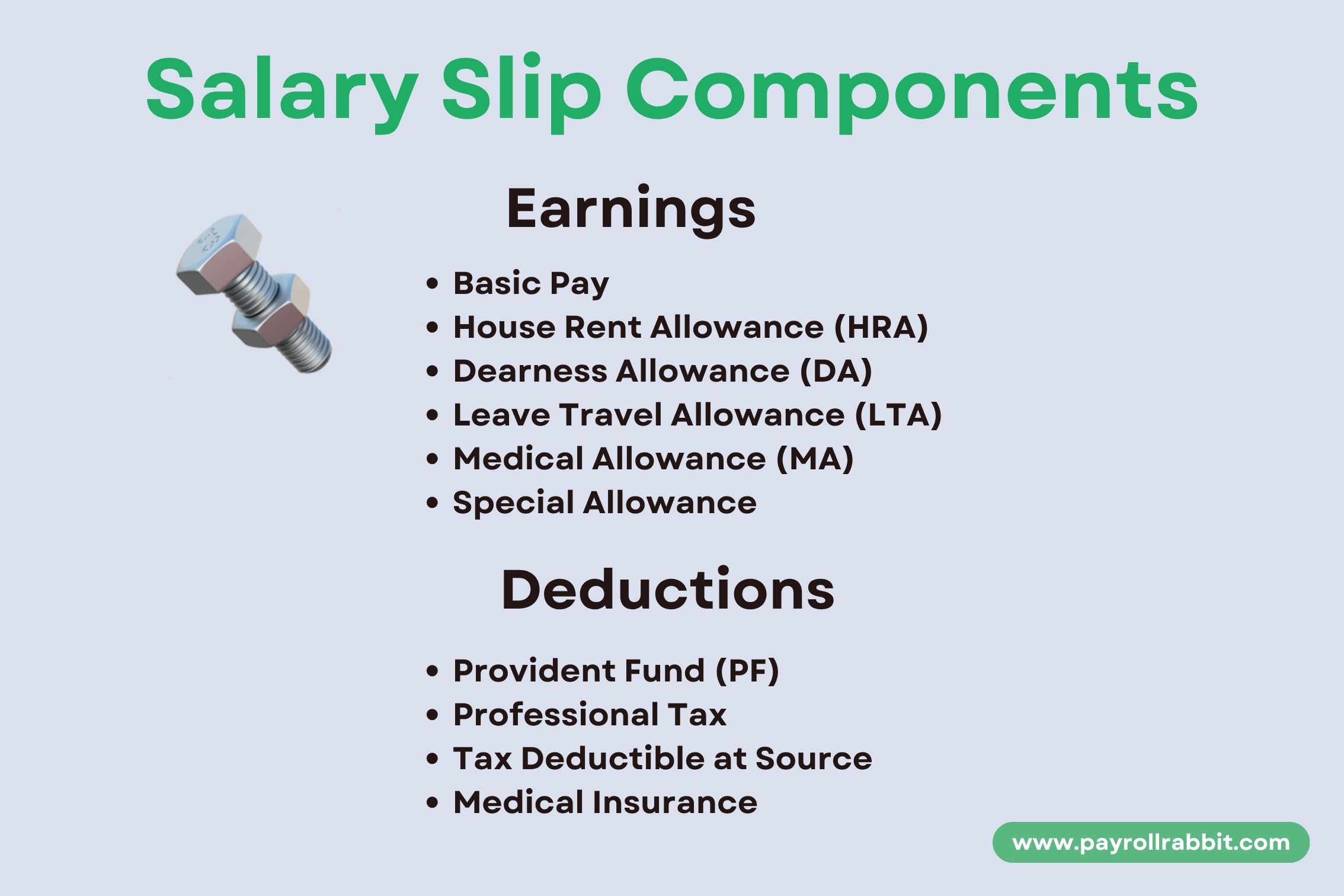

Salary Slip Components

A salary slip has two main components: Earnings and Deductions, each with multiple subsections. Here is a breakdown of each of them:

1. Earnings

The earnings section of the payslip shows the total money an employee earns, including their base pay and any additional benefits. The gross sum is shown here before any deductions are made.

Typical components of the salary slip's earnings include:

- Basic Pay: The fixed, essential portion of an employee's income before additional compensation or deductions is known as "basic pay."

- House Rent Allowance (HRA): Employees may receive a House Rent Allowance (HRA) from their employer to help with living expenses in rented accommodation. Despite being a component of your pay, HRA is not fully taxable. Subject to certain restrictions, a portion of HRA is exempt from taxation under Section 10(13A) of the Income Tax Act 1961.

- Dearness Allowance (DA): To counteract the effects of inflation, the government provides Dearness Allowance (DA) to employees and retirees as a cost of living adjustment. A percentage of the base pay is used to compute the DA. Thus, each employee's dearness allowance differs based on their base salary.

- Leave Travel Allowance (LTA): Employees receive Leave Travel Allowance (LTA) to cover their travel costs, usually on vacation. The Income Tax Act's Section 10(5) exempts LTA, provided specific requirements are met.

- Medical Allowance (MA): A Medical Allowance (MA) is a set amount that an employee receives from their employer, regardless of whether they experience medical costs or provide bills as evidence of their spending.

- Special Allowance: A Special Allowance is a sum of money that an organisation gives its workers for various reasons and objectives. From large corporations to sole proprietorships, all business entities have this clause requiring a predetermined and defined amount of additional payment.

2. Deductions

Deductions are deducted from the gross salary to calculate net pay. These can include insurance, taxes, and any voluntary or required withholdings.

Typical components of the salary slip's deductions include:

- Provident fund (PF): A Provident Fund (PF) assists salaried people in setting aside money for the future. The employer and the employee contribute a portion of their salaries to the fund, a mandatory savings scheme. Employees usually have access to this total sum, plus interest, when they retire or under certain circumstances.

- Professional tax: A professional tax is imposed on people who work in professions, trades, and other occupations. Although state-by-state variations exist in the amount of professional tax imposed, the annual limit is Rs. 2,500. Professional tax payments were deductible under the previous tax system, but not anymore.

- Tax deductible at source (TDS): Tax Deducted at Source (TDS) is the tax employees deduct from certain payments, such as interest, professional fees, rent, salary, etc. The deducted amount must be deposited with the Income Tax Authority using the deductee's PAN.

- Medical insurance: Medical insurance assists in covering the costs of medical care. This is especially useful for families and individuals, as it offers a safety net shielding them from potentially high medical demands, such as hospital stays, surgeries, and other treatments.

DA and HRA: What is the difference?

The HRA and Dearness Allowance are distinct elements and have different income tax treatment; hence, they do not conflate. One notable distinction is that only public sector employees are eligible for DA, while the HRA applies to both private and public sector employees. Furthermore, the HRA is eligible for some tax advantages that the DA is not.

| Comparison | Dearness Allowance (DA) | House Rent Allowance (HRA) |

|---|---|---|

| Purpose | Cost-of-living adjustment for public sector employees | Helps cover housing expenses |

| Calculation | Percentage of basic salary | Not a fixed percentage; varies with employer |

| Tax Exemption | Not tax-exempt | Eligible for tax exemptions |

| Applicability | Public sector only | Public & private sectors |

TDS and Professional tax: What is the difference?

Here are the differences between professional tax and tax deducted at source (TDS):

| Aspect | Professional Tax (PT) | TDS (Tax Deducted at Source) |

|---|---|---|

| Purpose | State tax on salary/profession/trade | Tax deducted at source as per Income Tax Act |

| Calculation | State slab rates; ₹2,500/year (max) | Varies by income type and section; no limit |

| Tax Exemption | Not charged if income is low, for seniors, disabled, military, or as per state rules | No TDS if payment is below limit, or if exempt under tax law |

| Applicability | Only in certain states (e.g., Maharashtra) | Nationwide, on various incomes |

Conclusion

The salary slip is the foundational pillar of trust in India's economy, as it guarantees transparency and keeps accurate records. Creating a clear and comprehensive salary slip is a key responsibility for employers or HR professionals. Thus, a properly formatted pay slip is a valuable tool that promotes professional documentation in the workplace and is more than just a monthly formality.

To simplify things for employers and employees, you shouldn't be afraid to invest in software that automates the payslip creation process. Human mistakes are inevitable when records are created manually. We highly recommend our free Payslip Generator, which creates payslips automatically.

Frequently Asked Questions (FAQs)

1. What is PT on a payslip?

The acronym PT stands for "Professional Tax." In India, state governments impose this tax on people who work as professionals or receive salaries, such as chartered accountants, doctors, and lawyers. The amount of PT varies by state and income level.

2. What does DA mean on a salary slip?

The acronym for "Dearness Allowance" is DA. Employees, particularly those in the public (some in the commercial) sectors, get this cost-of-living adjustment allowance to lessen the effects of inflation. It is computed as a proportion of the base pay.

3. What does YTD mean on a payslip?

YTD stands for "Year to Date." It shows the total amount of money earned or deducted from the start of the fiscal year to the present, including the total amount earned by an employee and the deductions made during the year.

4. On a salary slip, what are LOP days?

LOP stands for "Loss of Pay." It shows how many days a worker missed work during a specific time without receiving compensation. On LOP days, the employee's pay is withheld.

5. What does LWF on a payslip mean?

LWF stands for "Labour Welfare Fund." It is a statutory fund in India overseen by state governments that enhances workers' social security and working conditions. Employers and employees contribute to this fund, although each state has different requirements for the frequency and amount of contributions.